BBB Foods Inc

A neighborhood retail model built to compound!! "Take a simple idea and take it seriously." — Charlie Munger

BBB Foods Inc is best understood as an Aldi-like response to Mexican grocery economics. Under the Tiendas 3B brand, the company operates small-format, neighborhood hard-discount stores built around a limited assortment, private-label-heavy mix, and structurally low operating costs.

Like Aldi, BBB Foods competes by removing complexity: fewer SKUs, minimal staffing, standardized store layouts, and no advertising. The difference is geography. Hard-discount grocery remains underpenetrated in Mexico, accounting for just over 3% of the market, compared with approximately 38% in Poland, 25% in Turkey, and 24% in Germany - markets where Aldi-style formats are well established. The gap reflects the massive growth opportunity.

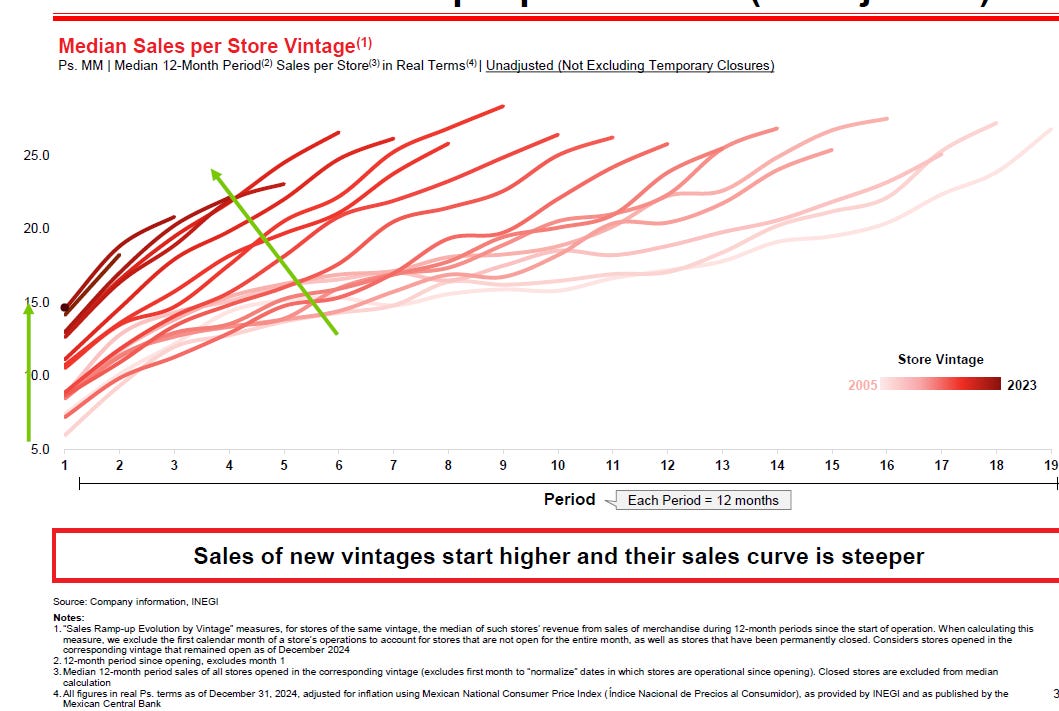

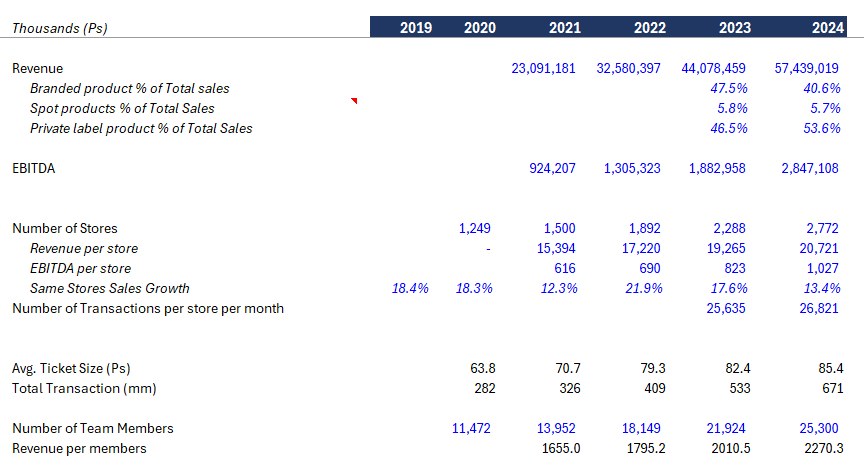

BBB Foods operates primarily in central Mexico, where it has scaled to roughly 3,200 stores, more than 50% of which were opened in the last four years. As a result, the majority of the store base has yet to reach mature sales levels; notably, even the earliest stores, including those opened in 2005, continue to show sales growth.

The model is designed to be profitable in communities with as few as 10,000 inhabitants, supported by low build-out costs, high inventory turnover, and frequent customer visits. Management believes this structure can support expansion to as many as 14,000 stores over time (4x store growth from here).

Future growth is driven by three reinforcing factors. First, continued store expansion into dense, underserved neighborhoods extends the footprint at low incremental cost. Second, as stores age, customer frequency increases and fixed costs are leveraged, improving store-level profitability. Third, rising private-label penetration shifts the sales mix toward higher-margin products as trust compounds over time. These dynamics allow revenue growth and margin expansion to occur simultaneously, without requiring changes to the underlying operating model.

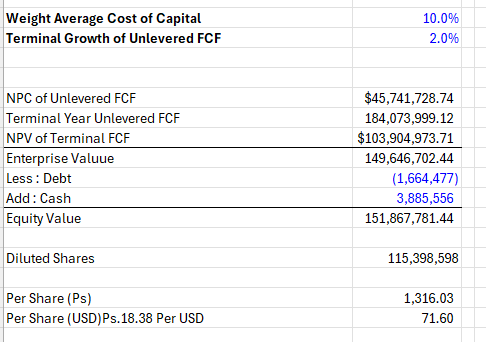

Given the combination of a young store base, structurally low costs, and a long runway for density-driven expansion, the earnings power of the business is still underrepresented in current financials. As these factors play out over the next two years, I believe the stock has a credible path to reaching $100+.

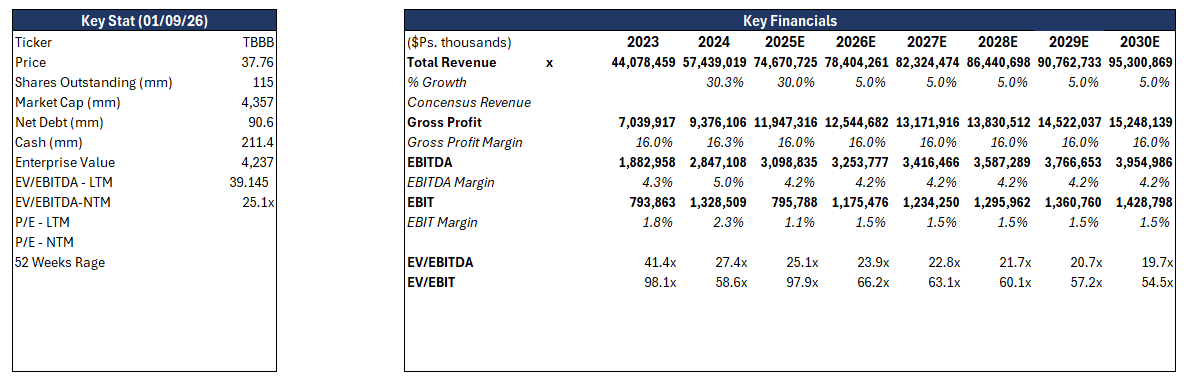

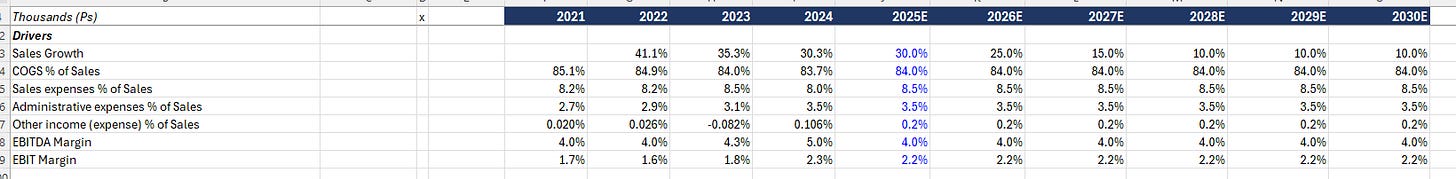

Summary Data

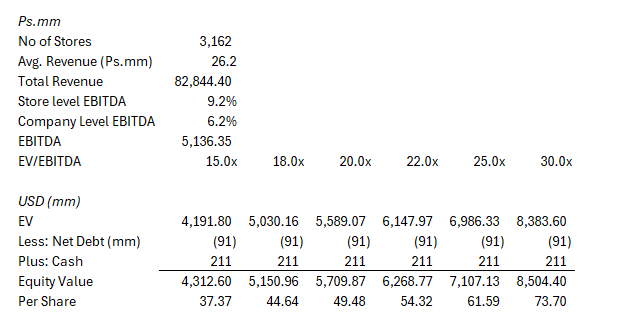

Valuation

What the Market Still Hasn’t Realized

The market appears to be valuing BBB Foods Inc based on current reported margins and near-term earnings, rather than the underlying trajectory of the store base and category penetration.

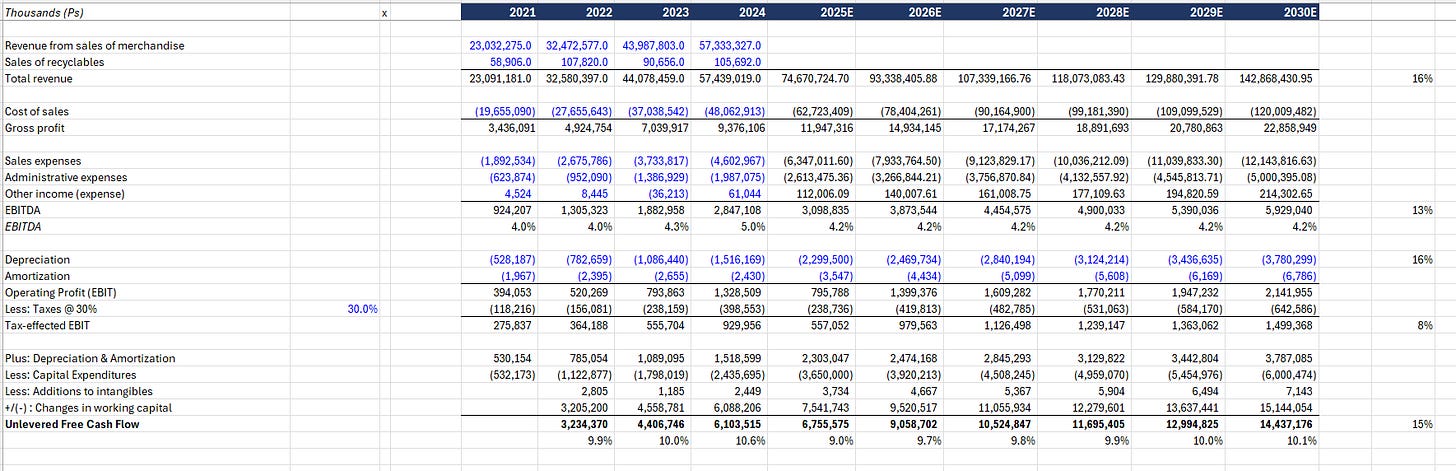

The growth runway is longer than implied : Hard-discount grocery penetration in Mexico remains just over 3%, leaving substantial room for expansion before saturation becomes a constraint. The business is still in a hyper-growth phase: full-year 2024 revenue was effectively reached within the first three quarters of 2025, indicating demand absorption is running ahead of market expectations. The stores opened in 2025 have not yet reached peak revenue.

Reported EBITDA understates steady-state economics : Store-level payback averages roughly 25 months. Of the 3,162 stores in operation, approximately 1,000 locations are younger than that threshold. As long as the company continues to open stores at this pace, consolidated EBITDA will remain structurally depressed by design, not by weakness in unit economics.

Store maturation drives both revenue and margin expansion : Current average revenue per store is approximately Ps. 20.7 million, with an EBITDA margin of 4.2%. By the third year, a typical store reaches around Ps. 26.2 million in revenue and 9.2% EBITDA at the store level. Even with no incremental store openings, revenue would approach Ps. 75 billion by the end of 2025 and roughly Ps. 82 billion by the end of 2026, driven purely by maturation of the existing base (very conservative assumption).

Valuation reflects the present, not the trajectory : At the current share price, the market appears to be capitalizing today’s margins while discounting the mechanical improvement that comes from a young store base aging into maturity. The result is a valuation that does not fully reflect the earnings power embedded in stores already open.

About BBB Foods Inc

BBB Foods Inc opened its first store in Mexico City in 2005, introducing the hard-discount grocery format to the Mexican market. Since then, the company has scaled rapidly, becoming one of the fastest-growing grocery retailers in the country by both sales and store count.

As of Q3 2025, BBB Foods operated 3,162 stores across 16 central Mexican states. The company does not advertise. Instead, stores are placed in high-foot-traffic neighborhoods close to customers’ homes, prioritizing convenience and repeat shopping while keeping customer acquisition costs structurally low. This proximity-driven footprint reflects a deliberate focus on dense markets where scale, logistics efficiency, and cost discipline compound over time.

Product strategy reinforces the model. BBB Foods carries roughly 800 high-rotation SKUs, focusing only on products where it can offer clear value for money. The assortment is intentionally narrow and continuously refined based on customer behavior, driving high sales per item and strengthening negotiating leverage with suppliers. Early growth relied more heavily on branded products to establish trust; as brand awareness increased, the mix shifted toward private labels. Private-label products accounted for 54% of sales in 2024, up from 47% in 2023, improving customer value while expanding gross margins. A no-questions-asked return policy - even without a receipt - reduces purchase risk, supporting private-label adoption and higher margins.

Operationally, BBB Foods is decentralized, enabling rapid store rollout. In 2024, the company opened roughly one store every 18 hours, with most of the footprint built within the past five years. Stores follow a standardized, stripped-down design—well lit, low shelving, and easy to navigate—reducing build-out costs while simplifying restocking and improving shopping efficiency. Density, assortment discipline, private-label penetration, and execution speed compound, widening the moat through scale and operational discipline rather than brand spend.

What They Sell, How They Win?

BBB Foods Inc built around assortment discipline rather than breadth. Where a large-format retailer like Walmart may carry tens of thousands of SKUs, BBB Foods limits its offering to a small set of products selected for consistent turnover and price competitiveness.

The core assortment consists of roughly 800 SKUs, focused on everyday essentials - staple food, household goods, and basic personal care items. The narrow selection concentrates demand, increases sales per SKU, and simplifies procurement and logistics.

Private-label products (54% of 2024 Sales) account for more than half of sales. By bypassing national brand marketing and distribution costs, BBB Foods can offer lower prices while maintaining good quality. As scale and brand trust increase, private label penetration rises, reinforcing both customer value and gross margin expansion.

In addition to staples, BBB Foods offers a rotating set of limited-time “spot” items (6% of sales) - opportunistic purchases such as small electronics or household goods sold at unusually low prices. These items are non-core but serve to increase visit frequency and basket size without expanding the permanent assortment or complicating operations.

Taken together, the model prioritizes value, speed, and repetition over choice, allowing BBB Foods to compete on price without relying on promotional spending.

Who buys it?

BBB Foods Inc primarily serves low-to-middle income households in Mexico, concentrated in the second through ninth income deciles. While the core customer is price-sensitive, the broader appeal increasingly extends to value-oriented shoppers across income brackets.

Stores are embedded in dense residential neighborhoods rather than destination retail centers. Most customers live within an approximately 800-meter radius of their preferred store, making shopping local by design. This proximity shifts behavior from infrequent stock-up trips to frequent, small-basket purchases.

Customers typically visit three to four times per week, buying enough for one to two days. Initial visits are driven by competitive pricing on branded and spot products; over time, familiarity and trust lead customers to adopt private-label items. Products not carried - such as fresh produce - are sourced from nearby neighborhood retailers, reinforcing BBB Foods’ role as a high-frequency staple store rather than a one-stop supermarket.

The result is a customer relationship defined less by basket size and more by repetition, with proximity and price driving habitual usage.

Why does it exist?

The company’s mission is summed up in its name, 3B, which stands for the Mexican saying “Bueno, Bonito y Barato” (Good, Nice, and Affordable). It exists to solve two main problems for the Mexican consumer:

Price: Inflation and constrained household budgets make everyday affordability a primary concern. BBB Foods’ small store format, lean staffing, and limited assortment structurally lower operating costs, allowing the company to offer consistently lower prices without relying on promotions.

Access: Large-format supermarkets are often distant and costly to reach. By locating stores within dense residential neighborhoods, BBB Foods brings modern retail within walking distance, reducing transportation costs and supporting frequent, small-basket shopping.

How does it make money?

BBB Foods Inc generates revenue by selling a narrow assortment of high-velocity everyday essentials through a dense network of small-format stores. As of Q3 2025, the company operated 3,162 locations, each designed to maximize throughput rather than basket size.

Approximately 54% of sales come from private-label products, with the remainder split between branded items (~40%) and opportunistic spot sales (~6%). The mix reflects a deliberate strategy: branded products establish trust and traffic, private label drives value and margin, and spot items increase visit frequency without expanding the core assortment.

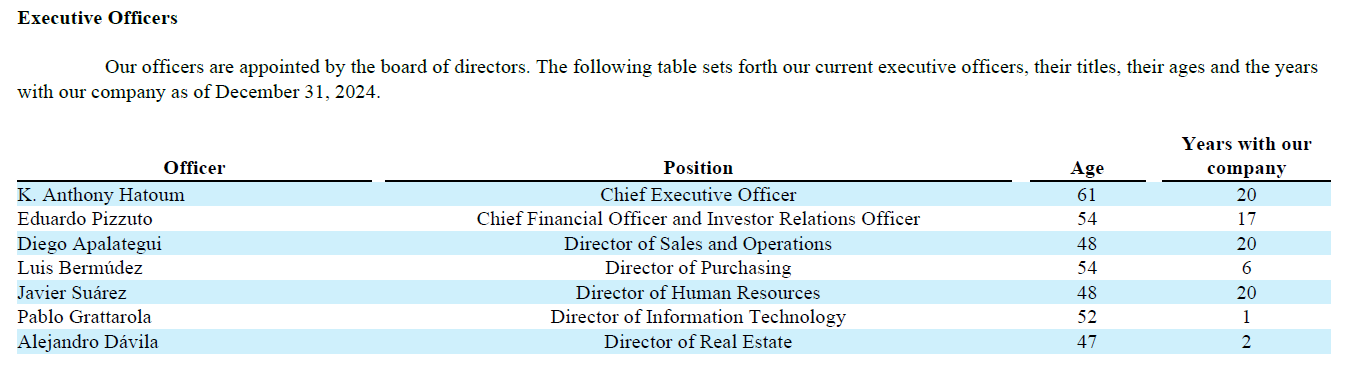

Management

BBB Foods Inc continues to be run by its founding team, including the founder, providing continuity between the original operating thesis and current execution. The company spent its first nine years deliberately small, using that period to refine the model before scaling. The result is a business that expanded only after unit economics were proven.

The organization is decentralized by design, enabling rapid store rollout while preserving local execution speed. Incentives are aligned toward protecting the model rather than maximizing short-term growth, reinforcing operational discipline as the footprint expands.

Decision-making is explicitly experimental. New initiatives are tested at small scale and incorporated only if they fit within the existing cost and operating structure. This bias toward validation over expansion reduces the risk of complexity creep and helps preserve the consistency that underpins the company’s economics.

Competitive Advantage

BBB Foods Inc is difficult to copy not because any single element is unique, but because the system is coherent. Like Southwest Airlines, the company has made a set of mutually reinforcing choices that work together - and it can’t be selectively imitated.

BBB Foods does not advertise. Instead, stores are located directly within high-foot-traffic residential neighborhoods, embedding customer acquisition into real estate rather than marketing spend. This choice lowers ongoing costs while increasing frequency and habit formation.

Real estate strategy reinforces the model. By targeting low- to middle-income, price-sensitive customers within an approximately 800-meter radius, the company can operate in cheaper locations and smaller formats. Combined with lean staffing and limited assortment, this allows stores to be profitable in communities with as few as 10,000 inhabitants.

Capital efficiency further compounds the advantage. Store build-out costs are low, working capital is structurally negative, and new locations can be funded internally - often with cash generated by two mature stores which are older than 3 years. Growth does not require external financing, reducing both risk and dilution.

Product strategy strengthens trust and margins simultaneously. Private-label products offer better value for money, while a no-questions-asked return policy lowers perceived risk and accelerates adoption. As scale increases, the limited SKU count concentrates volume, improving supplier terms and reinforcing price leadership.

Finally, brand awareness emerges as a byproduct rather than an input. New stores open with higher starting sales, indicating customer familiarity despite the absence of advertising. Loyalty is driven not by promotion, but by proximity, price consistency, and repeat utility.

The result is a system where cost structure, location strategy, assortment discipline, capital efficiency, and customer behavior reinforce one another. Competitors can copy individual features, but doing so without adopting the full set of constraints breaks the economics that make the model work.