Grab is the leading super-app in Southeast Asia, with dominant positions in ride-hailing and food delivery across eight countries. After years of prioritizing growth over profitability, the company has shifted toward a more disciplined operating model and has recently reached positive free cash flow.

Future growth is increasingly driven by financial services - digital banking and lending - sold to Grab’s existing mobility users, food consumers, and merchants in a largely underbanked region with unbanked populations. The logic is straightforward: built-in distribution, proprietary data, and low incremental cost to cross-sell.

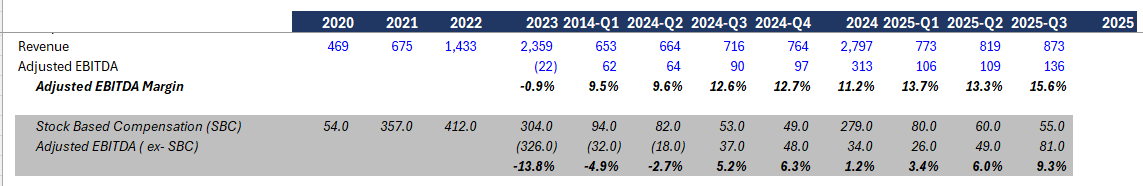

Profitability has improved primarily through cost cuts and efficiency gains, alongside a sharp decline in stock-based compensation from 28.8% of revenue in 2022 to 6.3% in the most recent quarter, rather than from higher take rates. Core pricing dynamics remain largely unchanged in a highly competitive, price-sensitive market. At the current valuation, there is little margin for error given execution risk and ongoing regulatory uncertainty. The risk-reward is not compelling.

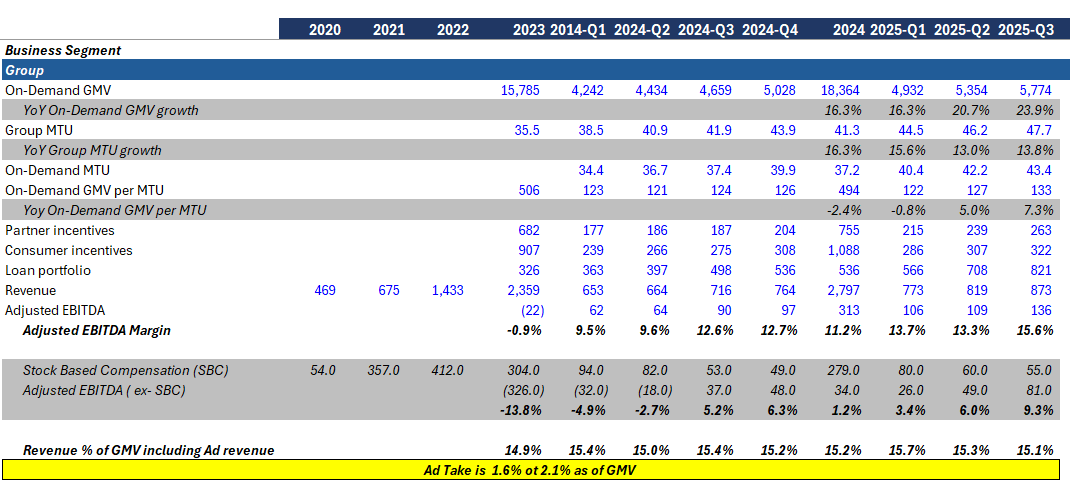

Adjusted EBITDA vs. SBC-Adjusted EBITDA

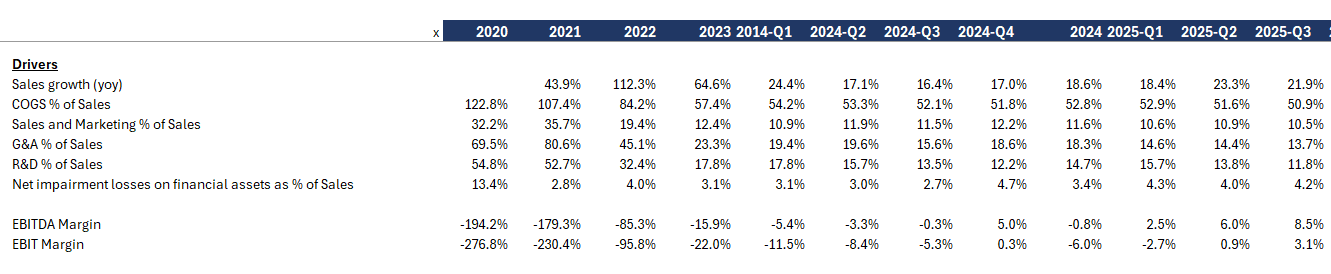

Profitability: Cost Reduction or Operating Leverage

Grab’s origin reflects founder-led problem solving: new products were built to fix internal constraints, such as launching lending to finance smartphones for drivers who lacked access. This approach has scaled effectively. But, betting on the company ultimately requires betting on the founder’s ability to keep identifying the right scalable problems at this stage of the company. Five to ten years from now, Grab will likely look very different - for better or worse. Even if you take away the advertising revenue, the core business is a low-margin utility. The real bullish thesis depends on their ability to grow advertising and financial services (lending) which have higher margins than moving people or things and food around.

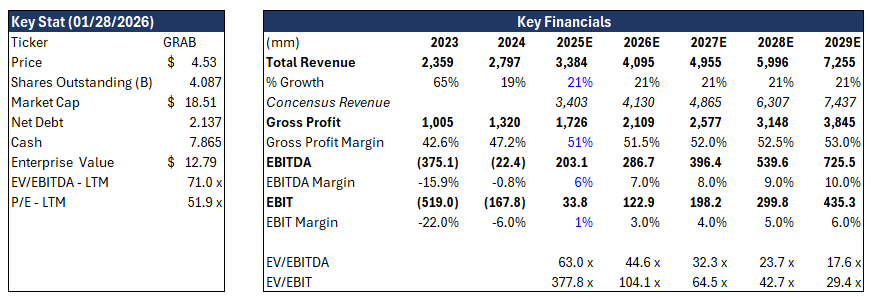

Summary Data

My View

Wall Street is broadly optimistic, with more buy ratings than sell ratings, but that optimism is not obvious to me.

Grab operates in an intensely competitive market where price ultimately wins and low-cost operators have the advantage. Running multiple pricing tiers (saver and premium options) across regions while sustaining both growth and margins requires constant optimization and innovation. That is a difficult environment to manage consistently over time and adds ongoing execution risk.

Profitability has improved, and growth is increasingly driven by adjacent products and features (some of them are viral in nature), including subscriptions, grocery, dine-out, group orders, Saver options, loyalty programs, and other incremental offerings. However, it is difficult to identify which products/features are truly driving growth and whether that growth is durable. This resembles a Red Queen dynamic, where the company must keep investing and innovating just to maintain its position.

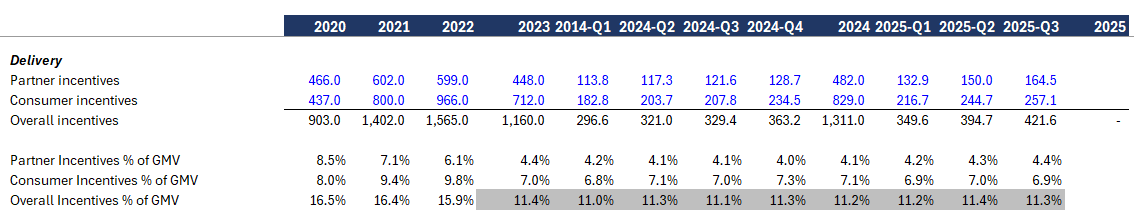

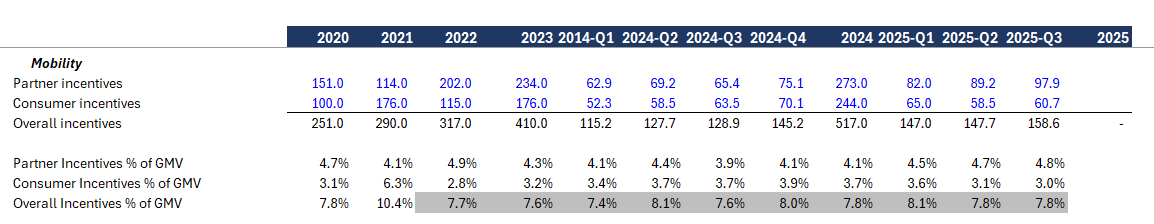

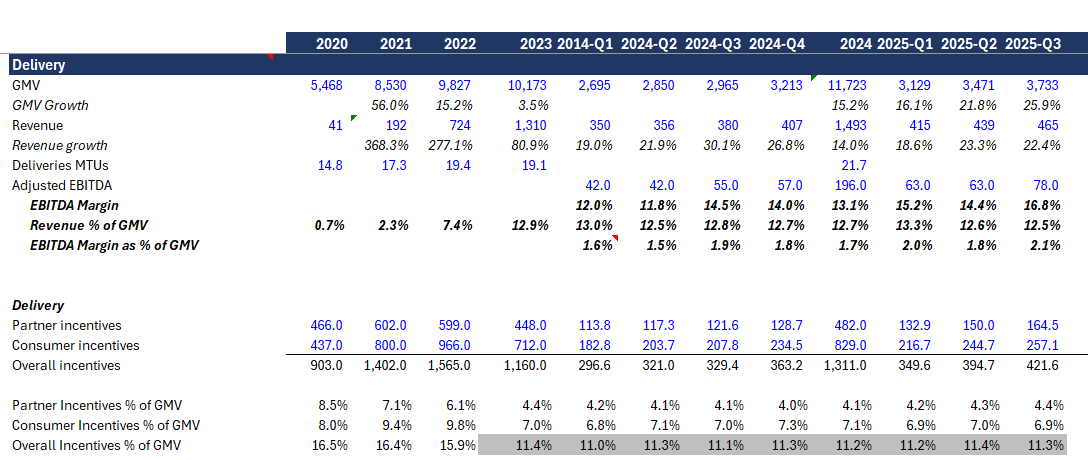

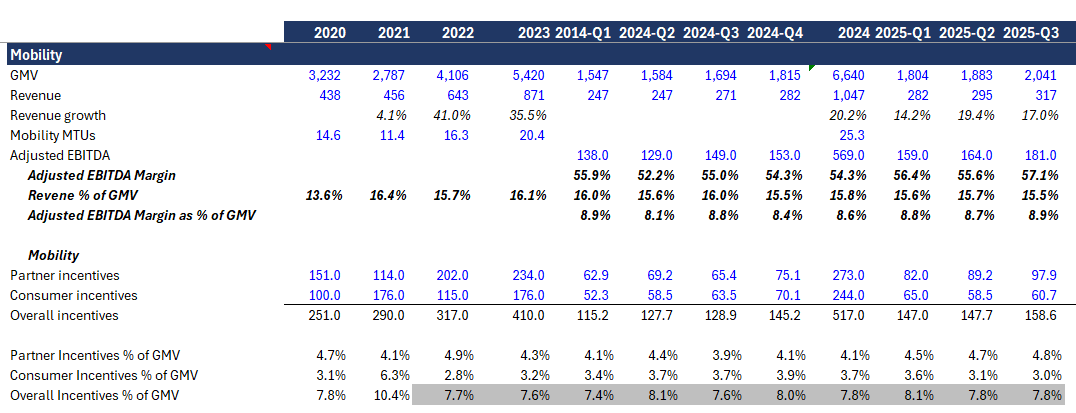

Despite ongoing product improvements (R&D as a percentage of sales declined from 17.8% in 2023 to 11.8% in Q3 2025), partner and consumer incentives remain largely unchanged from 2023 levels. Some initiatives support margins, such as advertising, while others - like Saver options - offset those gains. Overall, both sides of the marketplace remain highly price-sensitive, suggesting switching costs are minimal.

Delivery IncentivesMobility Incentives

There is uncertainty around the direction of the business model. Grab continues to launch new features and offerings, while at the same time moving toward a high-volume, low-commission model. Excluding the 2.1% contribution from advertising, take rates are declining, likely driven by increased use of Saver options (optimizing for quantity)

Core services (rides and food) are priced lower to drive volume and user growth in a highly competitive, low-discretionary market.

Monetization then comes from advertising sold to merchants and lending to drivers and merchant partners.

MTU grew 14% and transaction volume increased 27%. Despite lower prices, GMV per MTU rose to 133, but the sustainability of this growth remains uncertain, as it is driven by multiple factors, including viral features and additional offerings.

A large part of growth has come from geographic expansion, but further expansion is likely to be more expensive. Infrastructure across Southeast Asia is poor and traffic congestion is severe, making deeper market penetration costly. Management is now focused on monetizing existing users, and execution so far has been solid, but the durability of this phase remains uncertain.

The next growth lever is financial services, particularly lending. This is likely to be stickier on the merchant side, where many partners lack traditional credit histories and have limited access to financing, making Grab a default provider. On the consumer side, however, financial products are less differentiated, with low switching costs and many alternatives. While supply could eventually create demand, the business is not yet at that stage.

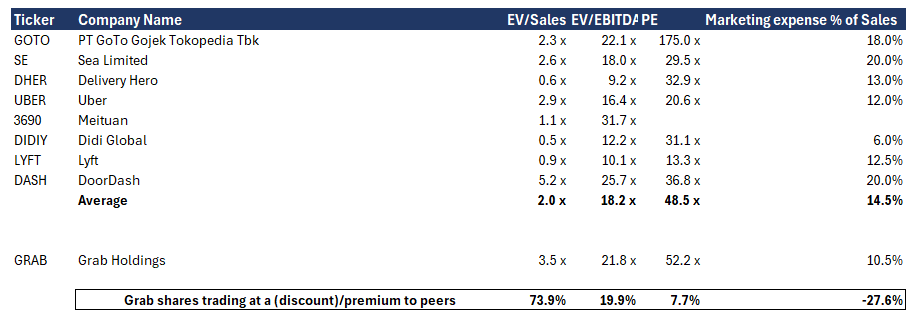

Valuation

Comp Table

Grab is founder-led and well-managed, and has recently turned free-cash-flow positive through better efficiency and product innovation and improvements. These positives are already reflected in the stock price, leaving the company fairly valued, if not expensive, relative to peers.

About Grab Holdings Ltd (GRAB)

The easier way to think of Grab is as if Uber, DoorDash, Venmo, and a digital bank were all combined into a single app. It is often described as the “Super App” of Southeast Asia.

Grab sells convenience and connection. It operates a massive digital marketplace that offers three main types of services:

Mobility : To get around, you can book a taxi, car, motorbicycle, or bus through their app.

Delivery: To get things, this includes GrabFood (restaurant meals), GrabMart (groceries and household essentials) and GrabExpress (sending packages or documents across town).

Financial Services : Many people in Southeast Asia don’t have traditional bank accounts, Grab created GrabPay. It’s a digital wallet used to pay for rides and food, but also to pay at the physical stores. They now even offer small loans, insurance, and digital banks.

Who does Grab serve?

Grab’s business relies on three different groups of people who all “buy” into the platform in different ways:

Consumers: Millions of everyday people across 8 countries (like Singapore, Malaysia, and Indonesia) who use the app to save time or solve daily problems.

Drivers and Delivery Partners: These are independent contractors who “buy” access to Grab’s technology to find work. Grab takes a small commission from every fare or delivery fee they earn.

Merchants: Restaurants and shop owners who use Grab to reach more customers. They pay Grab a fee for every order placed through the app.

Why does Grab exist?

It exists to solve two major challenges specific to the region:

Traffic and infrastructure : Many cities in the region have underdeveloped to nonexistent public transit with intense traffic congestions

Financial inclusions : A huge portion of the population in Southeast Asia is “unbanked,” meaning they don’t have credit cards or easy access to loans. Grab provides a way for these people to participate in the digital economy, pay for things electronically, and even build and create history for the first time.

It’s a monumental task and noble mission, but as a future shareholder will you be in a position to capture the upside?

How does it make money?

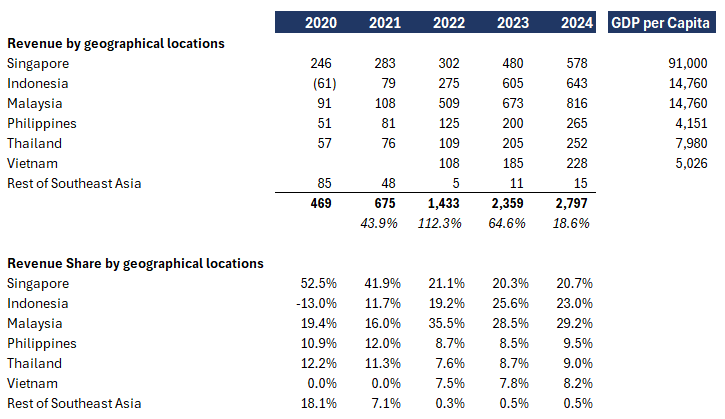

Grab operates across eight countries. Revenue is concentrated in Malaysia (29%), Indonesia (23%), and Singapore (21%). This mix has remained broadly stable since 2023. The remaining revenue comes from the Philippines, Thailand, Vietnam, and Cambodia.

Grab operates across three business segments. Mobility is the most profitable vertical. Deliveries is the volume driver, with GrabAds increasingly supporting monetization. Financial Services is currently near breakeven but is evolving from a payments utility into a lending and digital banking business with materially higher future profit potential. Together, Mobility and Deliveries - often grouped as on-demand - function as the primary customer acquisition channel for the Financial Services segment, lowering CAC and improving unit economics over time.

Delivery

Mobility

Financial Services

It is expected to break even in the second half of 2026.

Conclusion

There is no clear catalyst to justify a short, but also no compelling reason to buy at current levels. This is a stock to keep on a watchlist, either for further work or for a price that offers an obvious margin of safety.