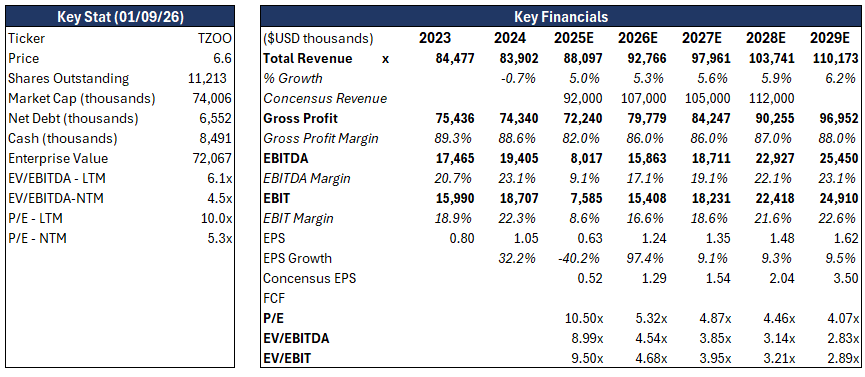

Travelzoo is an asset-light, profitable travel media business with a built-in marketplace. In 2024, the company generated approximately $84 million in revenue with an 88% gross margin. It is in the middle of a strategic shift to monetize the demand side of its platform through a paid membership model, which introduces higher-quality, recurring revenue on top of its existing advertising and commission streams.

Despite this transition, the company trades at a market capitalization of roughly $74 million and an enterprise value of about $72 million. This pricing implies the market is valuing the business as if its underlying economics are deteriorating rather than improving. As the subscription model scales and the revenue mix shifts toward recurring income, I believe the stock can re-rate and trade in the $15–$20 range over the next 12 months.

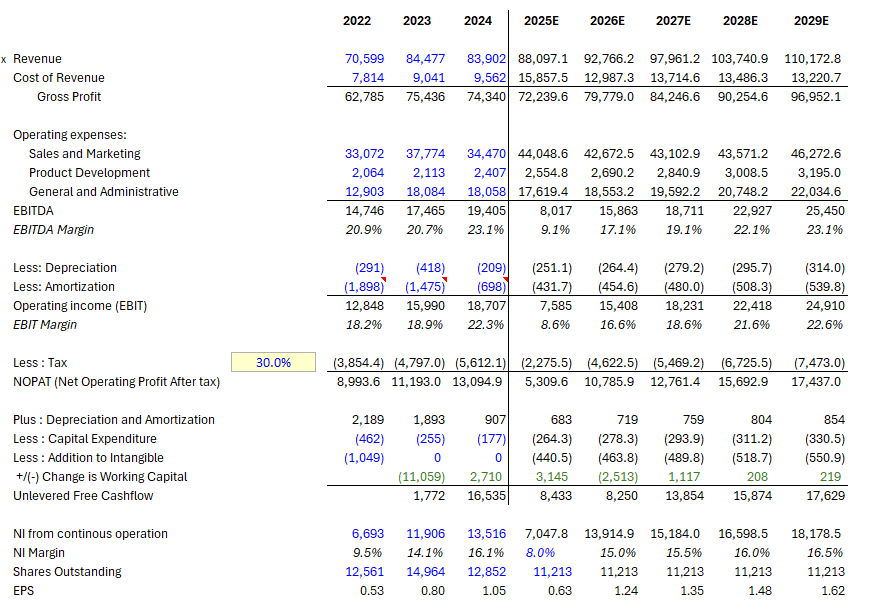

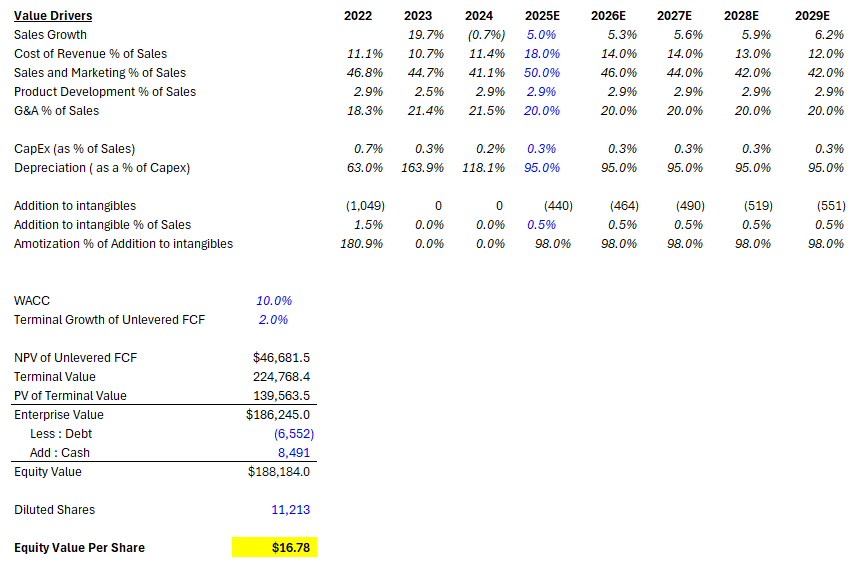

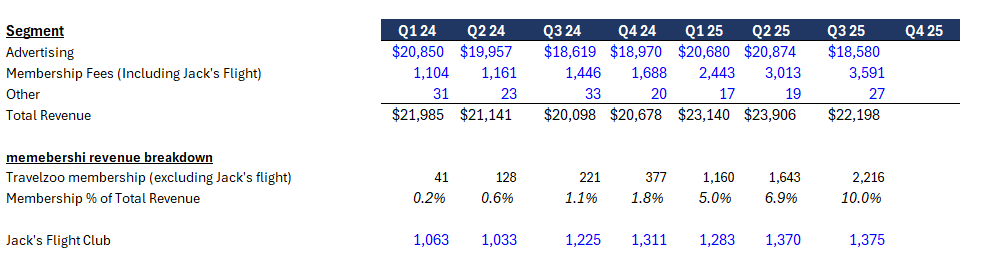

Summary Data

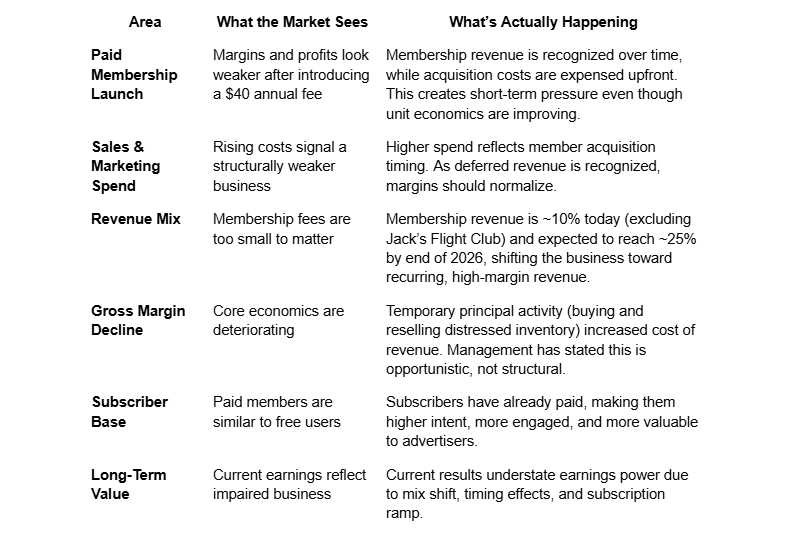

Variant Perception : What the Market is Missing

The market is focused on near-term accounting effects rather than the underlying shift in the business. Travelzoo is moving from a free, ad-driven model to one with paid members, recurring revenue, and higher-quality demand. That transition temporarily compresses reported margins, but it improves the long-term economics. As subscriptions scale and temporary effects roll off, reported performance should better reflect the business’s true earnings power.

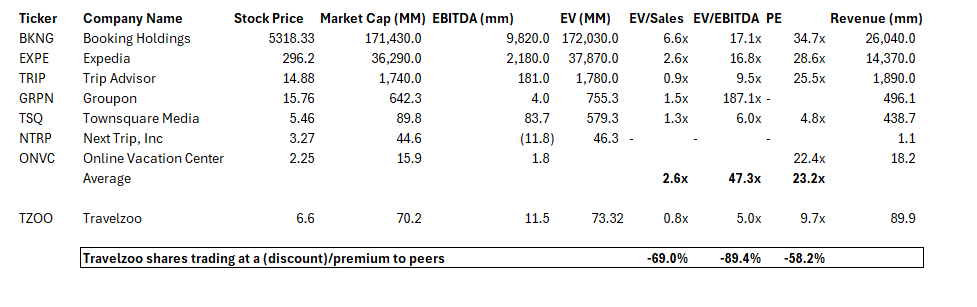

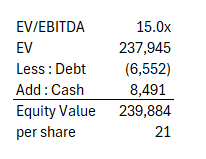

Valuation

Comp Table

DCF

Catalyst

Margin normalization as subscription accounting effects fade and revenue mix shifts, expected within the next two to four quarters.

Improved subscription disclosure, including growth, retention and engagement metrics, which management has indicated may begin around mid-2026 following the first major renewal cycle.

Multiple expansion from current all-time-low valuation levels as recurring revenue increases, margin improves, and cash flow quality becomes clearer.

About Travelzoo

Travelzoo is best understood as a curated discovery layer for travel.

Most travel websites are search tools. You arrive with intent: dates, destinations, prices. You already know what you want, and the platform helps you find it.

Travelzoo works in the opposite direction. People don’t come to Travelzoo to book a trip they’ve planned. They come to be told what trip is worth taking right now.

What Travelzoo Actually Sells:

Travelzoo is not a travel agency. It does not manage itineraries or operate hotels. It is a media company and a private club.

Its core product is curation.

The flagship product is the Top 20, a weekly list of the best travel deals in the world. These are not algorithmically ranked discounts. They are manually selected by deal experts who evaluate whether a deal represents real value relative to quality.

In addition to the Top 20, Travelzoo sells:

Vouchers for luxury hotels, resorts, and spas

Pre-packaged vacations and cruises

Local premium experiences (fine dining, events, getaways)

The deals skew high-end. A typical Travelzoo deal is a five-star experience priced like a three-star alternative.

Travelzoo serves two different customers:

Travelers (Members)

These are affluent, flexible travelers. They are not optimizing for the cheapest possible flight. They are optimizing for value, quality, and inspiration. They trust Travelzoo to filter noise and surface opportunities they would not have searched for themselves.

Travel Providers (Partners)

Hotels, airlines, cruise lines, and tour operators have a “perishable inventory” problem: unsold inventory expires worthless. A hotel room empty tonight cannot be sold tomorrow.

Publicly discounting that inventory damages brand perception. Travelzoo offers a quieter channel: access to a large, affluent, opt-in audience that expects premium deals.

In essence, Travelzoo is where excess capacity goes without looking desperate.

The Problem It Solves:

The internet created overwhelming choices - much of it low quality or driven by fake discounts. It exists to reduce decision fatigue.

For travelers it replaces hours of searching with a shortlist of vetted opportunities. For travel providers, it replaces broad discounting with targeted exposure.

The value proposition is not price alone. It is TRUST.

“You can’t make a good deal with a bad person” - Warren Buffett

“It takes 20 years to build a reputation and five minutes to ruin it” - Warren Buffett

How Travelzoo Makes Money

Historically, Travelzoo monetized only one side of the platform, with travel providers paying advertising fees and commission to reach its 30 million members. That audience, however, included many casual browsers with low booking intent.

The shift to a paid membership model (~40/year) changes the quality of the user base. Paying members signal higher intent, which improves conversion rates on deals. A smaller but motivated audience is more valuable to travel partners than a large, mixed-intent list.

This transition increases monetization on both sides: recurring subscription revenue from members and higher advertising value for Travelzoo as partners reach a qualified, high-intent audience. Over time, this also enables better and more exclusive deals, reinforcing the value of the membership.

In short, the membership model trades scale for intent - and raises revenue per user across the platform.

What Travelzoo really is:

At its core, Travelzoo is a media company with a marketplace attached. It doesn’t win by scale or logistic, but by editorial judgment.

In a world increasingly driven by algorithm and AI-generated recommendations, Travelzoo’s advantage is that it deals are:

Hand-curated

Often exclusive

Anchored in long-standing supplier relationships.

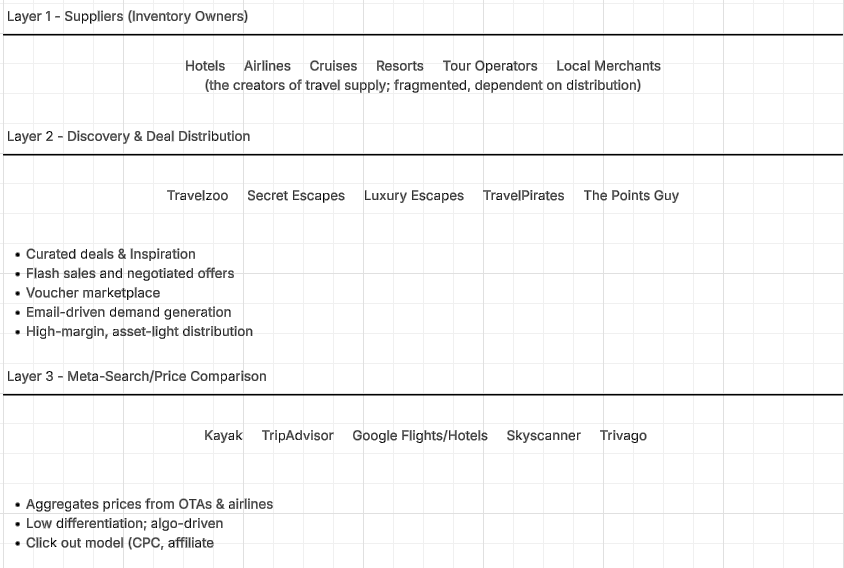

Industry Structure and Travelzoo’s Role

The global travel industry can be boiled down to five layers:

Layer 1 — Supply (the inventory owners)

These are hotels, airlines, cruises, resorts, and tour operators. This layer is extremely fragmented. They all want the same thing: more visibility, more customers, and more revenue.

Layer 2 — Discovery and Demand Generation

This layer answers two basic questions for travelers: Where should I go? and What’s a good deal?

They don’t run booking engines and they don’t own inventory. They send traffic or voucher sales to customers/members and make money through ads, commissions, or subscriptions. What matters here is trust and curation.

Examples: Travelzoo, Secret Escapes, Luxury Escapes, The Points Guy.

Layer 3 — Meta-Search / Comparison Sites

They compare prices and send users elsewhere to book. Very utility-focused, algorithm-driven, and not curated.

Examples: TripAdvisor, Kayak, Skyscanner, Google Flights.

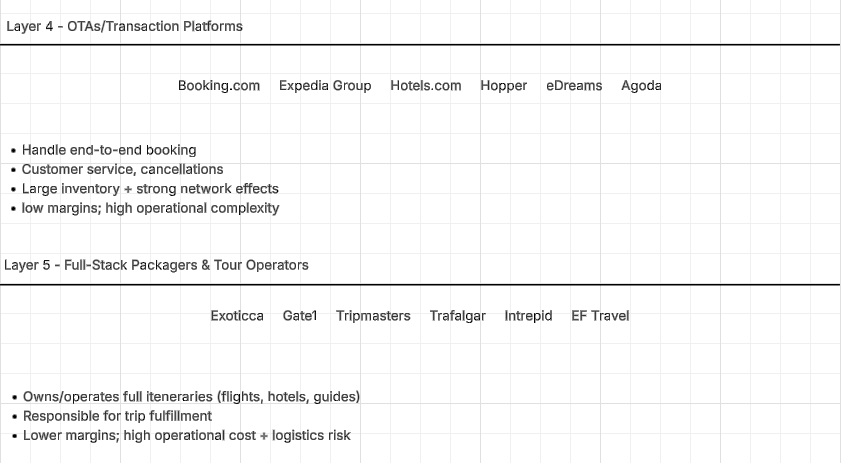

Layer 4 — OTAs (Online Travel Agencies)

They handle transactions. This is a brutally competitive, low-margin layer with high customer service costs. Network effects matter because more traffic brings more inventory and vice versa.

Examples: Booking.com, Expedia, Priceline, eDreams ODIGEO.

Layer 5 — Full-Stack Travel Operators / Packagers

They build and fulfill entire trips. High operational risk and lower margins because they take on inventory and service obligations.

Examples: Tripmasters, Exoticca, Globus.

Travelzoo operates in the travel industry’s discovery and demand-generation layer (Layer 2). Its role is to surface compelling travel ideas and deals and direct demand to suppliers. It does not own inventory, run a booking engine, or package trips. It is not a search product and it is not algorithmic. Its value comes from editorial judgment and trust.

This layer exists because travel decisions are made before price comparison begins. Most trips start with a vague intent - I want to go somewhere - not with a destination or a search query. Layer 2 captures that moment. It shapes demand upstream, before travelers reach OTAs or supplier websites.

For suppliers, this layer solves a structural problem: travel inventory is perishable. Empty hotel rooms and unsold seats lose value every day. Layer 2 platforms allow suppliers to generate incremental demand, especially off-peak, without resorting to broad discounting or expensive advertising. That is why suppliers fund this layer.

For OTAs and booking platforms, Layer 2 is complementary, not competitive. It sends users who have already decided to travel and often where to go. These users convert better than generic search traffic. OTAs are optimized for transactions and scale; discovery is not their strength, and moving upstream would weaken their core economics.

Layer 2 works precisely because it is different from the rest of the stack. Search and meta-search optimize for price and ads. OTAs optimize for volume and conversion. Tour operators take operational and inventory risk. Layer 2 optimizes for trust. That makes it asset-light, high margin, and low risk.

Competitors from other layers are unlikely to move into Layer 2 in a meaningful way. Suppliers do not want to build consumer media brands. OTAs and search platforms are structurally tied to ads and auctions, which undermines editorial trust. What makes them successful elsewhere makes them poorly suited to curated discovery.

As travel options increase and AI floods the market with content, recommendations, and “deals,” trust becomes scarcer. More information does not reduce decision-making costs; it increases them. That strengthens the role of platforms that filter rather than aggregate.

If this layer did not exist, discovery would collapse into paid search and ads. Travelers would do more work, suppliers would spend more to acquire customers, and OTAs and Google would gain even more power. The system would become less efficient overall.

Layer 2 persists because it improves outcomes for every other layer. It creates demand earlier, lowers acquisition costs, and simplifies decisions. As travel becomes noisier and more complex, the value of curated discovery increases - not because of technology, but because of trust.

Competitive Analysis

The discovery and deal-distribution layer sits within the broader digital advertising market, not within travel bookings. It is a fragmented niche rather than a winner-take-all category, but it tends to concentrate around a small number of trusted brands because credibility compounds over time.

The market size is driven by two budgets: how much travel suppliers are willing to spend on promotion, and how much consumers are willing to pay for trusted discovery. Both are functions of attention and trust, not transaction volume.

This layer also benefits from a broader secular shift in advertising. According to Zenith, online advertising is expected to account for roughly 61% of total ad spend by 2026, growing at a mid-single-digit rate as budgets continue to move away from TV and print toward digital, social, and performance channels. Travelzoo operates entirely within this shift. Its audience is high-intent by definition - members have already paid to be there - which makes the platform attractive to advertisers looking for efficient demand rather than raw reach.

Structurally, growth in this layer is low to mid single-digit, roughly in line with digital advertising. The upside comes from mix, not volume: subscriptions and rising information overload increase the value of curation, allowing the strongest brands to grow faster than the underlying market.

Participants

Travelzoo

Secret Escape

Luxury Escape

The Points Guy (content-led)

Small newsletters, influencers, and deal aggregators

Key Characteristics

No Inventory ownership

No fulfillment

No price comparison

Trust-based discovery

Barriers to Entry

Trust is hard to build : Credibility with consumers takes years. One bad deal damages the brand.

Supplier relationships take time : Access to exclusive deals requires long-term relationships and proven demand quality.

Curation is labor-intensive : This is not an algorithm problem. Editorial judgment does not scale easily.

Audience quality matters more than size : High-income, engaged members are harder to acquire than generic traffic.

Email and membership lock-in

Once trust is established, switching costs are behavioral, not contractual.

Competitive Advantages

Strong brand association with deal quality : Members expect real value, not fake discounts.

Editorial curation as the product : Most deals are rejected. Scarcity reinforces trust.

High-income, loyal member base : Attractive to suppliers seeking quality demand.

Asset-light economics : No inventory risk, no fulfillment, minimal customer service burden.

Subscription layer strengthens moat : Direct monetization aligns incentives with users, not advertisers.

Risks

Execution risk in subscription conversion : Members must perceive ongoing value to pay.

Supplier concentration risk : Reduced promotional budgets during downturns.

Management capital allocation history : Past acquisitions have not created clear value.

Brand erosion risk : Any decline in deal quality directly hurts trust.

What’s Changed in the Industry

Explosion of choice and noise : More destinations, platforms, and AI-generated “deals.”

Trust scarcity : Everything looks like an ad; consumers seek filters.

Shift toward paid discovery : Subscriptions replace pure advertising models.

OTAs and search platforms become more ad-driven : Weakening their role in trusted discovery.

Travelzoo sits upstream of OTAs and downstream of suppliers. It shapes demand before transactions occur. Other layers rely on it but cannot easily replicate it:

Suppliers don’t want to build consumer media brands.

OTAs and search platforms are structurally tied to ads and auctions.

Algorithms optimize price and clicks, not trust.

Layer 2 exists because it improves the efficiency of every other layer. As travel becomes noisier and more complex, curated discovery becomes more valuable - not less.

Management

The current CEO has been with Travelzoo since 1999. He served as CEO from 2008 to 2010 and returned to the role in 2016. Under his leadership, the company has been run lean, disciplined, and conservatively.

Insiders own a large stake in the company (34.7% as of September 30, 2025), which aligns incentives through meaningful ownership. At the same time, it limits independent oversight, as seen in several related-party acquisitions tied to the founder’s side projects.

Travelzoo has completed multiple acquisitions, but none have materially improved the business. Travelzoo APAC (2015) and Travelzoo META (2022) were founder-related. The 2020 acquisition of Jack’s Flight Club did not meaningfully increase revenue and later resulted in a $2.9 million impairment. Its main value appears to have been learning rather than financial contribution.

Operationally, the company remains profitable, asset-light, and debt-free. Editorial discipline and deal curation are strong, but the overall business has not changed materially. Management communication is generally clear and non-promotional. The team is not exceptional, but it is competent and disciplined.